top of page

Search

America's $36 Trillion Debt Era: The Ripple Effects of Trump’s “One Big Beautiful Bill”

As of 2025, U.S. national debt has exceeded $36 trillion, setting a historic record. Amid growing concerns on Wall Street over the...

Gayeon Lim

Jun 8, 20253 min read

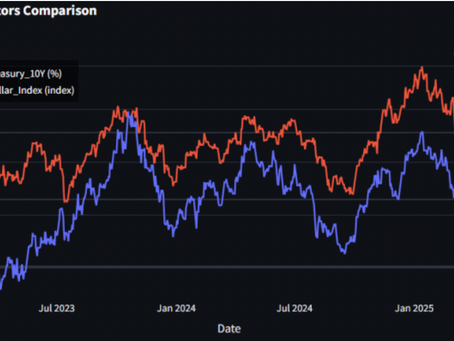

Cracks in Dollar Hegemony: The Collapse of the Correlation Between U.S. Treasury Yields and Dollar

U.S. 10-Year Treasury Yield vs. Dollar Index (Source: IFE Analytics) Prologue: A Shattered Golden Rule of Financial Markets For 75 years...

Gayeon Lim

Jun 3, 20256 min read

U.S. Treasuries Break the 5% Barrier, A Seismic Shift in the Global Financial Order Begins

The Magic Number 5% Breaks 30-Year U.S. Treasury Yield Trend – Past 5 Years (Source: Yahoo Finance) Since May 21, the yield on the...

Gayeon Lim

Jun 3, 20254 min read

U.S. Consumer Sentiment in ‘Historic Slump’... Inflation Fears and Tariff Troubles Cast a Shadow

Consumer Sentiment Index Nears 'Record Low' Again In May 2025, the University of Michigan Consumer Sentiment Index plunged to 50.8,...

Gayeon Lim

Jun 1, 20253 min read

Yield Curve Inversion and Macroeconomic Indicators: Crisis or Opportunity?

Today, let's examine the yield curve inversion, one of the key indicators of the U.S. economy, and its correlation with various...

Justin Jungwoo Lee

Sep 3, 20244 min read

Recent Trends and Implications of Short-term and Long-term US Inflation Expectations

1. Inflation Expectations Inflation expectations play a crucial role in understanding the current economic situation and predicting...

Justin Jungwoo Lee

Aug 20, 20243 min read

Decoding America's Economic Pulse: A Deep Dive into Inflation, Consumer Sentiment, and Spending Patterns

Two-thirds of the U.S. GDP is comprised of household consumption. To comprehensively understand the U.S. economic situation, it's crucial...

Justin Jungwoo Lee

Aug 12, 20243 min read

Long-term Investment Strategy for U.S. Treasury ETFs: Opportunities in the Rate Cut Era

Considering recent economic trends and Federal Reserve movements, the anticipated federal funds rate cut starting this September could...

Justin Jungwoo Lee

Aug 11, 20242 min read

Hidden Patterns in the U.S. Housing Market: Policy Rates, Mortgages Rates, and ETFs

The U.S. housing market is closely tied to various economic indicators. Among these, changes in U.S. monetary policy have a significant...

Justin Jungwoo Lee

Aug 8, 20243 min read

Global Financial Markets Shaken by Yen Carry Trade Unwinding: Analyzing Key Indices and Trends

Earlier this week, a sudden surge in the yen caused the unwinding of yen carry trades, shaking global financial markets. Yen carry trade...

Justin Jungwoo Lee

Aug 7, 20242 min read

Black Gold Surprise: America's Energy Dominance and Middle East Policy

Question: Who is the world's top oil producer today? While most might think it's Saudi Arabia, the surprising answer is the United...

Justin Jungwoo Lee

Aug 6, 20242 min read

Global Market Turmoil: The Perfect Storm of Yen, Tech, and Jobs

The storm that hit global markets last Friday has continued into Monday. The sell-off that began in Asia has spread to the U.S. markets...

Justin Jungwoo Lee

Aug 5, 20243 min read

Middle East on the Brink: A Tug of War Between Escalation Risks and Deterring Factors

Tensions between Israel and Iran are escalating, while ceasefire negotiations in Gaza have reached an impasse. This situation risks...

Justin Jungwoo Lee

Aug 4, 20242 min read

The Utility Sector in the AI Era: New Opportunities for Growth

The recent AI infrastructure investment frenzy by Big Tech companies is breathing new life into the utilities sector. Traditionally...

Justin Jungwoo Lee

Aug 4, 20242 min read

Silicon Valley's AI Gamble: Big Tech's Trillion-Dollar Bet vs. Wall Street's Skepticism

Recently, Wall Street's view of Big Tech has been turning skeptical. However, Big Tech companies are maintaining their plans for enormous...

Justin Jungwoo Lee

Aug 3, 20244 min read

Yen's New Direction: How Japan's Interest Rate U-Turn is Shaking Global Markets

Changes in the Bank of Japan's Interest Rate Policy and Its Impact The Bank of Japan has recently raised its benchmark interest rate...

Justin Jungwoo Lee

Aug 3, 20242 min read

Political Economy of Global Oil Prices: Who Moves the Prices?

Now that the beginning of the year has arrived, let's take a closer look at the trends in oil prices. Below is a chart of the past 5...

Justin Jungwoo Lee

Jan 1, 20243 min read

새해 첫날 짚어보는 미 경제 주요 지표들

11월 중국의 Retail Sales는 침체를 못 면하고 있으나, 이와 반대로 미국의 Retail Sales는 견고한 성장을 보여주었다. 지난 금요일 발표된 11월 PCE(Personal Consumption Expenditure) Price...

Justin Jungwoo Lee

Dec 31, 20231 min read

Japanese Yen- 본격 반등의 서막인가

현재 일본 엔화가 반등하는 추세를 보이고 있다. 11월 중순에는 달러 대비 151엔을 돌파하며 최고점(달러 대비 엔화 최저점)을 기록하였고, 이후 4주 연속 하락세를 보이고 있다. 특히 주목할 점은, 10년 만기 미국 국채 수익률과 일본 국채...

Justin Jungwoo Lee

Dec 10, 20231 min read

중국 위안화 강세 (Sept 28, 2020)

중국 위안화 강세가 지속되고 있다. 지난 6월말/7월초 달러당 7.1 위안 수준으로 저점을 찍고 상승하여 현재 6.8위안 수준을 보이고 있다. 이번 3분기에 약 3.7% 상승하며, 2008년 이후 가장 높은 큰 상승세를 보이고 있다. 원인은 크게...

Justin Jungwoo Lee

Sep 30, 20201 min read

bottom of page