top of page

Search

The Bitter Lesson of Politicized Monetary Policy: The Nixon-Burns Affair as a Warning

Richard Nixon, U.S. President (first on the left), and Arthur Burns, then-Federal Reserve Chair (first on the right)(Source: Getty Image)...

Gayeon Lim

Aug 4, 20254 min read

The Fed at a Crossroads: Inside the Powell vs. Waller Divide over a September Rate Cut

A debate unfolding in the 12th-floor boardroom of the Federal Reserve building in Washington is shaping the fate of global financial...

Gayeon Lim

Aug 2, 20254 min read

Trump’s ‘Mr. Too Late’ Attack: A New Game Threatening Fed Independence?

Yesterday afternoon at the Federal Reserve headquarters in Washington, a symbolic scene unfolded: President Donald Trump and Fed Chair...

Gayeon Lim

Jul 31, 20254 min read

The New Dilemma in the Age of Stablecoins: Government Debt Shrinks While Private Credit Dries Up

A $2 Trillion Market Shift That Could Reshape U.S. Monetary Policy There’s one number keeping U.S. Treasury Secretary Scott Bessent up at...

Gayeon Lim

Jul 30, 20254 min read

Trump’s Pressure on the Fed: A Modern-Day Revival of 1940s Financial Repression?

Introduction: Does History Repeat Itself? Markets were shaken when reports emerged that President Donald Trump was considering firing...

Gayeon Lim

Jul 29, 20254 min read

The Backlash of Trump’s Tariffs: How the 2.7% U.S. Inflation Spike Could Trigger a Global Asset Market Shake-Up

The Return of Inflation Stronger Than Expected Yesterday’s U.S. June Consumer Price Index (CPI) report showed a sharp increase to 2.7%,...

Gayeon Lim

Jul 26, 20253 min read

The Hidden Side of China’s 5.2% Growth: A Critical Warning for Korean Investors

China reported 5.2% GDP growth in Q2, seemingly placing it on track to meet its annual target. However, behind this figure lie structural...

Gayeon Lim

Jul 24, 20253 min read

The Truth Behind the Copper Tariff Bomb: How It Will Reshape Your Investments and Daily Life

Cooper Price (Source: Yahoo Finance) When President Trump announced a 50% tariff on copper imports, U.S. copper futures surged 13% in a...

Gayeon Lim

Jul 22, 20254 min read

Korea’s Triple Dilemma: A Monetary Policy Trapped Between a Real Estate Bubble and Trade War

Introduction: A Policy Authority’s Dilemma The Bank of Korea froze the base interest rate at 2.5% on Thursday, July 10. This decision is...

Gayeon Lim

Jul 21, 20254 min read

Dramatic Rebound of U.S. Equity Funds: What the 10.1% Q2 2025 Surge Tells Us

Market Resilience and Shifting Investor Sentiment The global financial market in the first half of 2025 was marked by rollercoaster-like...

Gayeon Lim

Jul 16, 20253 min read

Trump’s $4.5 Trillion Tax Cut Bill: A Double-Edged Sword for Financial Markets

The U.S. Congress is fiercely debating President Donald Trump’s record-breaking tax cut proposal. The bill, which outlines tax reductions...

Gayeon Lim

Jul 16, 20254 min read

A Resilient U.S. Economy Amid Trade Wars—But Consumers Are the Wildcard

The Real Impact of Trump’s Tariffs and What Record-High S&P 500 Levels Really Mean Worst Case Scenario Averted For Now... The S&P 500...

Gayeon Lim

Jul 10, 20253 min read

A New Paradigm in Commodities: The Era of Extreme Volatility and Its Ripple Effects on the Global Economy

World Bank Identifies 'New Commodity Regime' Challenging Global Financial Markets and Central Banks The Changing Landscape of the...

Gayeon Lim

Jul 8, 20253 min read

A Fractured Fed, Silent Market: Reading the Mixed Signals of the 2025 Financial Landscape

Dot Plot (June 18, 2025) Crisis Looms, Yet Markets Remain Quiet—Why? June 2025, Global financial markets remain eerily calm. Despite...

Gayeon Lim

Jun 30, 20253 min read

Ceasefire Agreement Between Israel and Iran Triggers Complex Financial Chain Reactions

News of a ceasefire agreement between Israel and Iran triggered an immediate and complex response in global financial markets. First,...

Gayeon Lim

Jun 29, 20252 min read

Oil Prices Hold Firm Amid War: A New Equilibrium in the Global Energy Market

(Source: Wall Street Journal) This blog analyzes the reason why crude oil prices are remaining unexpectedly stable despite the escalating...

Gayeon Lim

Jun 26, 20254 min read

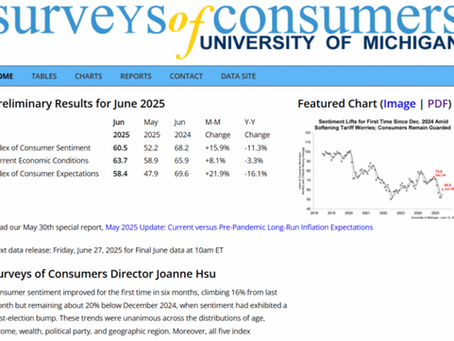

The Aftermath of Tariff War: A New Paradigm for U.S. Consumer Sentiment and Economic Outlook

Signs of Recovery Amid Uncertainty, But Structural Concerns Remain Preliminary data from the University of Michigan's June Surveys of...

Gayeon Lim

Jun 17, 20254 min read

The Upset of Real Interest Rates, A Warning Letter to Asset Markets – What 2025 Charts Tell Us About the Future Investment Landscape

The Structural Rebound of Real Rates: The End of a 40-Year Decline, Start of a New Era (Source: Financial Times) After nearly four...

Gayeon Lim

Jun 14, 20254 min read

The Paradox of Digital Dollar: Stablecoins Are Shaking the Foundations of the Global Financial System

(Source: Requoted from Financial Times) As the line between crypto and traditional finance fades, stablecoins are no longer mere digital...

Gayeon Lim

Jun 13, 20255 min read

The End of the Shale Revolution? U.S. Oil Output Decline Signals an Energy Paradigm Shift

EIA Forecast Dampens Trump’s ‘Energy Dominance’ Agenda In the first week of 2025, the U.S. Energy Information Administration (EIA) issued...

Gayeon Lim

Jun 12, 20252 min read

bottom of page